-

News

-

Knill James News and Blog

-

Archive

Knill James is delighted to announce that its client, J & A Investments, has successfully sold Toolout, Langley Engineering and Jointing Technologies to Wolseley Infrastructure. The deal achieved Knill James' preferred dual outcomes of maximum return for their client, while also securing the best possible future for the business.

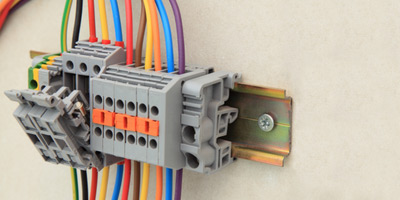

Jointing Technologies specialises in the distribution of power cable and accessories to the low, medium and high voltage markets, as well as being the leading provider of electrical trace heating systems in the UK. Wolseley Infrastructure is a key distributor to civils and utilities under the Burdens & Fusion brands. This acquisition will help both businesses capitalise on the growth potential in the electricity market as it evolves. Both brands will be retained along with all existing sites and personnel. The deal will build on Jointing Tech's strong growth in recent years and enable it to continue to expand its customer base and offering by focusing on the highest levels of customer service and product expertise.

Knill James managed the entire transaction as lead advisors, providing corporate finance advice, as well as expertise on tax and VAT. Adam Lloyd, Chairman of Jointing Technologies, commented: 'This exciting new stage in the company's development will ensure the continuity of our brand, the security of jobs and long-term consistency for our customers. We were extremely impressed by the skill and responsiveness of the advisory team at Knill James. In particular, their Corporate Finance Director Kirsty Wilson was there for us 24:7. Her calm, confident approach and expert handling of the deal meant we could focus more time on the day-to-day running of our business, knowing the deal was in safe hands.'

Chris Ketley, Business Growth and Advisory Partner at Knill James commented: 'We have had a long-standing relationship with Adam, having acted for Jointing Technologies for some time, and are delighted to see him achieve a successful sale after years of hard work in the business. We are extremely proud to have been assisting him on the strategic growth, development and advisory aspects of the business over a number of years.'

Kirsty Wilson, Corporate Finance Director at Knill James, commented: 'We understand that this kind of transaction can be life-changing for the vendors involved. We were delighted to work with Adam, not only on negotiating the best sale agreement, but also ensuring that it was successfully completed. We wish Adam and the team every success for the future.'

DMH Stallard LLP acted as legal advisors to the vendor.