The UK left the EU on Friday 31 January 2020 and the transition period ended on 31 December.

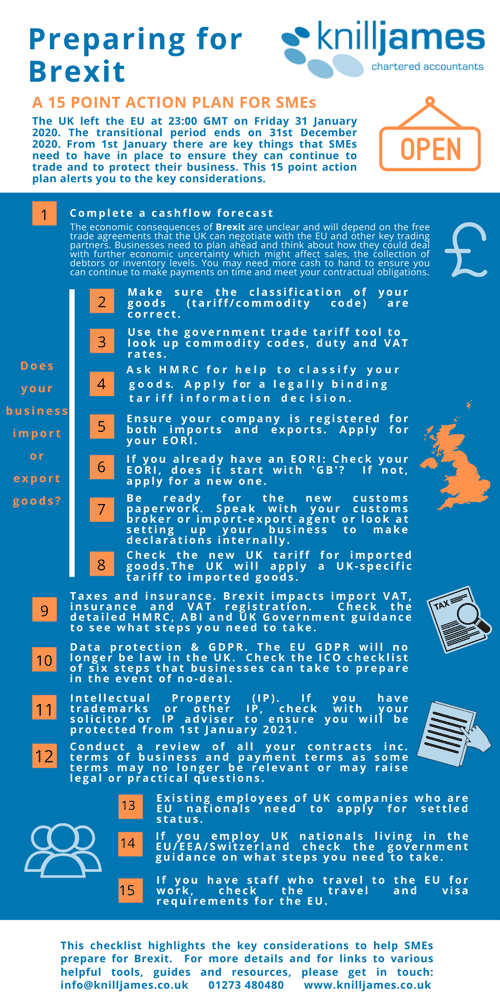

From 1 January 2021 there are some significant considerations for all SMEs, not just those who are involved in importing/exporting or travel, including:

- New customs paperwork and tariffs

- Changes to data protection and contracts

- Visa and travel requirements e.g. when travelling for work

In addition, businesses that import or export goods, either as sales or in their supply chain, must register for an EORI (Economic Operators Registration and Identification) number.

The economic consequences of Brexit are as yet unclear and depend on many factors. But businesses need to plan ahead, including preparing cashflow forecasts to ensure they know what money they need and when, as well as where they will get it from. You can download an example cashflow forecast template here.

It is important for SMEs to act now to avoid any disruption to their business.

To help SMEs prepare, we have produced the 15-point action plan below and also a detailed helpful guide here and which includes useful links to tools and further resources.