-

Services

-

Tax

-

Corporate

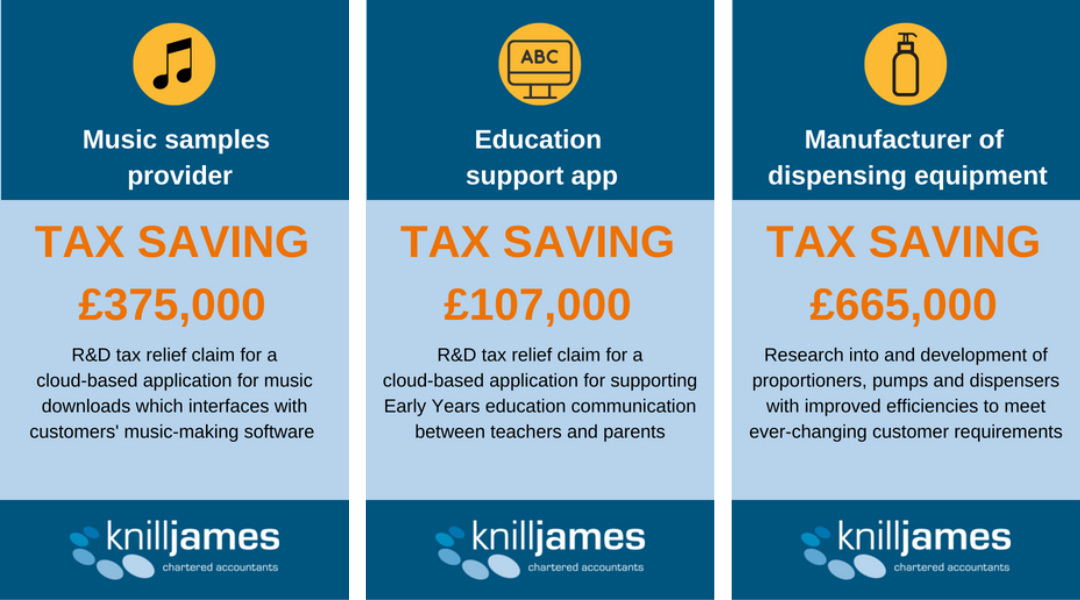

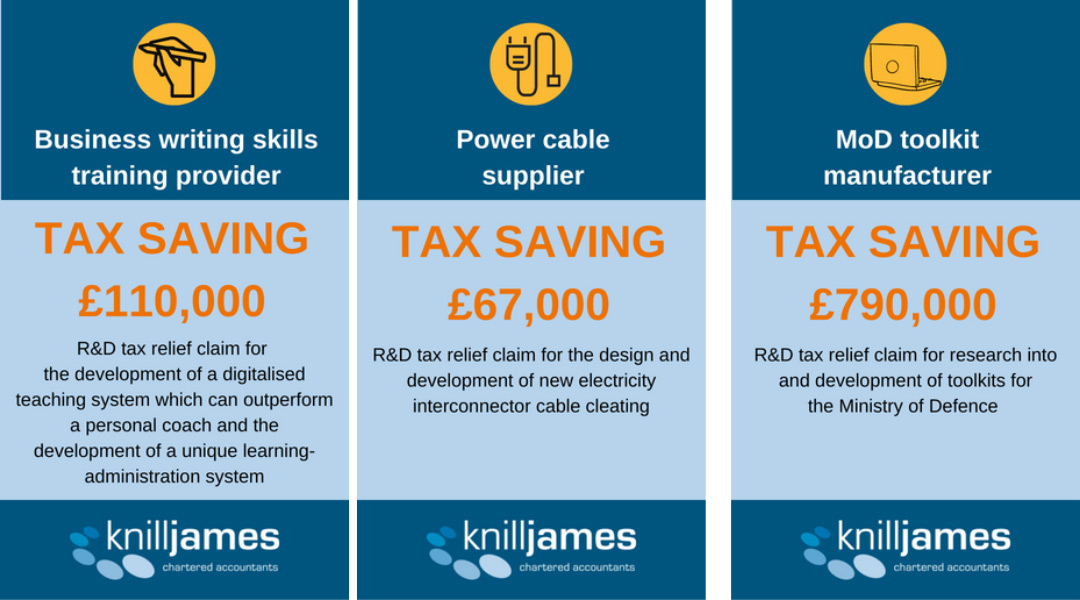

Research and Development (R&D) tax relief is a tax incentive available to companies. You can read our latest client briefing on R&D here:

Claims can be made under the R&D tax legislation where a company is undertaking a project that seeks to achieve an advance in overall knowledge or capability in a field of science or technology through the resolution of scientific or technological uncertainty

Activities that may qualify include developing new products, processes or services, or improving those that already exist. You may have an idea that you think is feasible, but you aren’t sure how to achieve the end result.

We will work with you to enable you to include accurate R&D claims in the company tax returns, and we’re best placed to provide this advice as we know your business. We can also assist with HMRC enquiries into claims that haven’t been prepared by Knill James.

For more details about how we can help, read our leaflet here https://www.knilljames.co.uk/services/tax/corporate/eis-and-seis

Meet the Experts

Want to know more?

Then get in touch with Mike Chapman - Tax Partner

01273 484913 | mike@knilljames.co.uk