VAT was originally designed to be a simple tax, yet it has evolved into one of the most complex and burdensome tax regimes that businesses face. The result has been that businesses, charities and other organisations are left with a slew of questions. Clients often contact us with queries such as Should I be registered for VAT? How do I fill in this VAT return? Should I opt to tax a property? Can I claim all the VAT I incur? And is there any long term VAT planning that I should consider?

Whilst the answer to some of these questions are simple and straight-forward, others need specialist VAT advice from people who understand the relevant legislation, rules and regulations relating to VAT. Our expert team at Knill James is here to help, from guiding you through the initial registration through to the much more complex areas of applying VAT correctly.

With the implementation of Making Tax Digital (MTD) and the introduction of the VAT reverse charge for construction services coupled with ongoing Brexit uncertainty, VAT understanding and planning have never been so pertinent.

The VAT Domestic Reverse Charge

The VAT Domestic Reverse Charge was introduced on 1 March 2021 for certain supplies that fall within the Construction Industry Scheme. Check these useful flowcharts and the CIS340 guidance to see how it affects you.

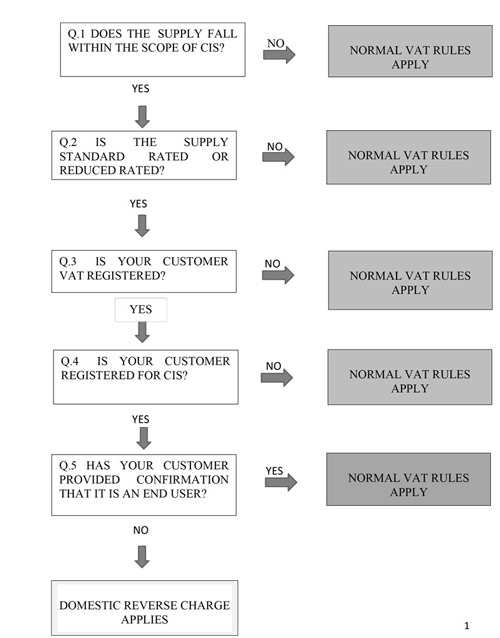

Supplier Flowchart

Use this flowchart to see how you would decide whether to apply normal VAT rules, or apply the domestic reverse charge.

Do not use it for services supplied by employment businesses.

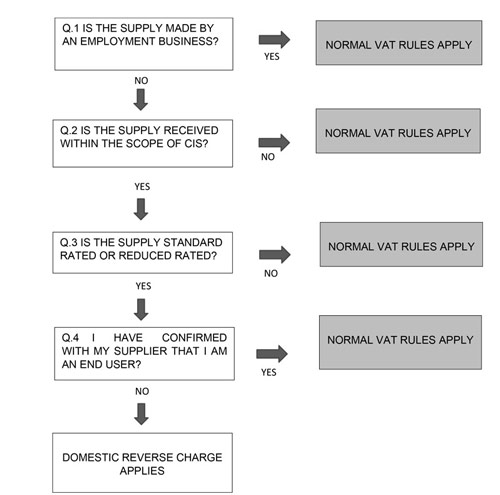

Customer Flowchart

This flowchart is to help businesses receiving building and construction services check whether normal VAT rules or the domestic reverse charge.

¹ Further information on ‘Employment Business’ can be found at Employment businesses and labour only sub-contractors.

² If there is any uncertainty around the CIS treatment, you should contact the CIS Helpline on 0300 200 3210 (or +44 161 930 8706 if outside the UK).

³ If there is any uncertainty as to whether the reverse charge applies, you should contact the VAT Helpline on 0300 200 3700 (or +44 2920 501 261 if outside the UK).

For more information and guidance, please follow these links:

CIS340 – HMRC Guide Construction Industry Scheme Guide https://www.gov.uk/government/publications/construction-industry-scheme-cis-340/construction-industry-scheme-a-guide-for-contractors-and-subcontractors-cis-340

CIS340 – HMRC Guide to Construction Industry Scheme, Appendix C, clarification of supplies included or excluded https://www.gov.uk/government/publications/construction-industry-scheme-cis-340/construction-industry-scheme-a-guide-for-contractors-and-subcontractors-cis-340#appc

HMRC Technical Guide to VAT Reverse Charge https://www.gov.uk/guidance/vat-reverse-charge-technical-guide

If you need any further help, please contact our Senior VAT Consultant, Alison Sampson.

To find out more about our VAT Advisory Services click here to view our help sheet.